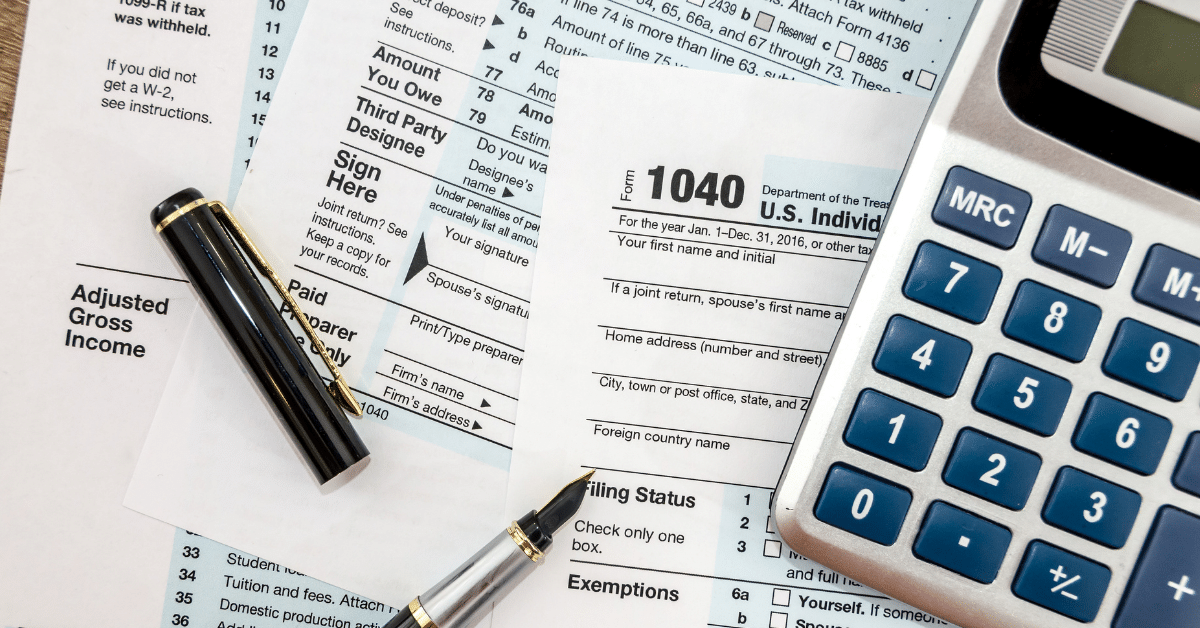

The H&R Block Tax Calculator is one of the most popular tools for estimating tax refunds. H&R Block provides this calculator for free on their website, and all you need is your social security number, current address, amount of income before taxes in 2017, and any deductions that you’re eligible to take. If you’re not sure how to use the H&R Block Tax Calculator or how it works then don’t worry! We’ve got the scoop on that right here.

There are several “free tax calculators” available on the internet that may be helpful in determining your tax situation. The online tax calculators available now are quite accurate, as long as you know the elements that will influence your position. These tools are simple to use for individuals who have tax circumstances such as individual filers with children.

The amount of your tax refund will be determined by a variety of factors. Your tax situation would be different depending on who you are, where you work, and the City and State in which you reside. Without getting into an extended discussion about each calculation, the following information is taken into account.

The H&R Block Tax Calculator is great tax software that can help you calculate your taxes. It breaks down the information into three major categories: About You, Income, and Expenses.

The major benefit of this calculator/estimator is that it incorporates a wide range of factors into its calculation. Child tax credits, earned income tax credits, and other family deductions and subsidies are all factored in during the data gathering process. H&R Block is one of the most trusted tax services in America, so you know that H&R Block’s calculator will be accurate.

It only takes a few minutes to use H&R Block Tax Calculator and it could save you hundreds or even thousands of dollars on your taxes! The H&R Block Tax Calculator can help you estimate how much money you’ll get back for free, which means more money in your pocket at refund time.

The H&R Block Tax Calculator is great because it helps people determine their estimated income range before they file their taxes so they can see if they owe anything or not. If there are no major changes to what someone has listed as expected deductions and credits then this tool provides an excellent ballpark figure of what someone can expect to receive as a refund or owe come tax time.

The H&R Block Tax Calculator is an amazing tool that will help you ensure your taxes are correct and also give you insight into how much money H&R Block might be able to save you! The H&R Block calculator takes all of the calculations out of doing one’s income taxes, which means more time for fun activities like going on vacation with the family after the New Year has begun.