Different life stages have significant tax implications. One of these very important tax stages is marriage. When you get married, you are eligible to file taxes with your spouse. There are many consequences to filing a tax return with your spouse.

Benefits of tax savings

There are many tax credits and tax credits available to joint filers. Many of these tax cuts are either available at a much lower value for those who are married separately, or not at all. The maximum number of people who file joint tax returns is also much higher for various tax opportunities. Therefore, for many couples, joint submissions can save tax.

Possibility of tax bracket shift

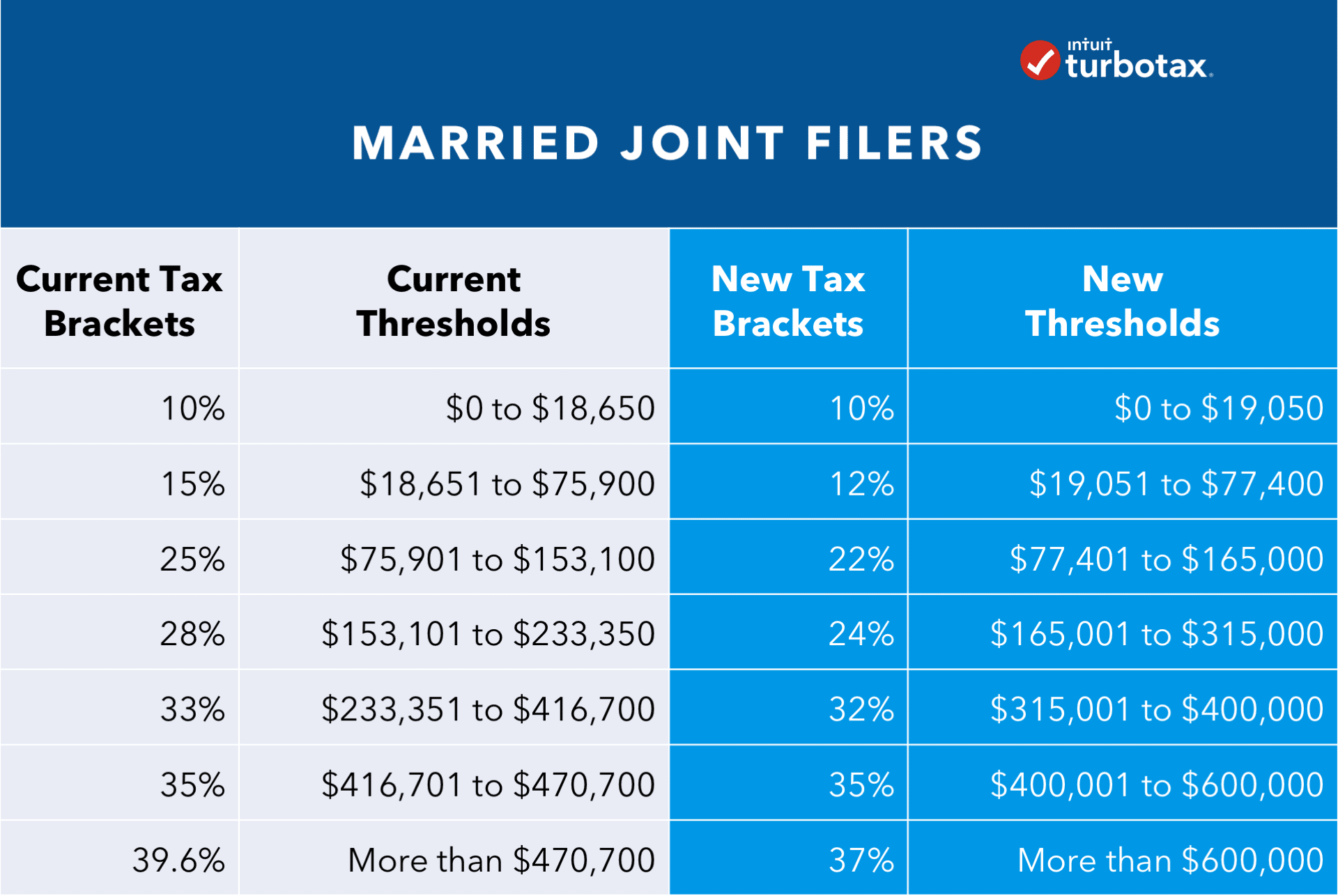

Another benefit of changing your filing status from single to tax brackets married filing jointly is that you can move to either a higher or lower tax rate. The tax rate you shift depends on the total income you earn as a couple. If one spouse’s income is higher than the other’s spouse’s, joint income may result in less net tax being paid. However, in some situations, if the couple declares separately, the couple may be forced into a higher tax rate than both individual tax rates, especially if both spouses earn very high incomes at the higher tax rates. there is. Therefore, you need to assess the potential consequences of taxes submitted jointly and separately to determine which is more favorable to your situation.

Joint obligation

One of the implications of joint filing is that both spouses are responsible for tax filing. Therefore, if you have debts arising from your tax return, both spouses are responsible for the payment. This is especially important if one of your spouses hides her income from the other spouse and does not declare it in that income (and if the IRS discovers this). Both spouses are liable for such undeclared income and can cause problems for innocent spouses.

Relief of an innocent spouse

The unfair position of an innocent spouse in a situation where tax obligations arise from unreported or unfamiliar misinformation can lead to the establishment of “innocent spouse relief.” Innocent spouse relief is an opportunity offered to an innocent spouse who realizes that the innocent spouse is obliged to pay her taxes without knowing or affecting herself. If you apply for this remedy and are given generosity by the IRS, your tax obligations will shift from your innocent spouse to your completely “guilty” spouse.

Many innocent spouses have taken advantage of this remedy to avoid liability for tax issues that they could not control. However, innocent spouse relief rules still limit individuals in unreasonably severe tax situations. Remedies are only available to spouses who have been able to apply for remedies within two years of the IRS discovering the problem. This two-year limit prevents many spouses from being unfairly obliged to pay taxes and unable to apply for relief within the two-year period.

Tax law holds different tax rates for married, single, and head of household. Over the years, tax professionals and legislators have been discussing and striving to address the pros and cons of submitting jointly as a couple, rather than as a single submission. Depending on the tax credit you belong to and the deductions and credits you qualify, marry, or rather jointly submit as a couple, you will be either positive or negative with respect to tax. For some spouses, submitting jointly may mean paying more taxes (all other factors are kept constant) and submitting with other spouses. That can mean that you pay less tax. Those who pay less will receive a marriage tax bonus, and those who pay more will receive a marriage tax penalty.

Under current tax law, the tax rate for most people who tax brackets married filing jointly is almost double that of singles and other filing categories. This means that even if both spouses earn the same amount of income, the tax rates will remain the same regardless of whether they are single or jointly married. Therefore, for couples whose income is significantly lower than that of the other spouse, the combined income may result in a lower tax rate and may benefit from a marriage tax bonus.

In addition to tax credits, deductions and deductions vary in scope between those submitted as a single and those submitted jointly. Therefore, whether you get a marriage tax penalty or a tax bonus depends on all these factors. Therefore, if you plan to get married soon, be sure to check the impact of your tax return changes and be prepared for the taxable period.