There are times when somebody exceptionally near us goes through monetary difficulties and ask us for help. We as a whole have heard the well-known axiom on cash and its incidental effects on connections. However, as somebody, they search for in the troublesome occasions. At the same time, it is your obligation to help them.

Loaning cash to family or companions chances the relationship as well as it lot depends upon the monetary circumstance of the lending institution. It will help if you discover an answer that will take care of their cash issue without harming your accounts.

What would be that source? Whom should you approach? How quickly can you get that financial support?

There are many questions available in front of us even if we want to support our acquaintances. In this blog, we will dedicate our discussion to finding out the answers to it.

Ways to reckon while helping financially to your near and dear ones

At here, we have referenced such approaches to help your relatives in monetary pain. You can understand them and try to implement them in your efforts. We cannot guarantee that the outcome will come in your favour, but at least, you should try them once.

- Personal Loan

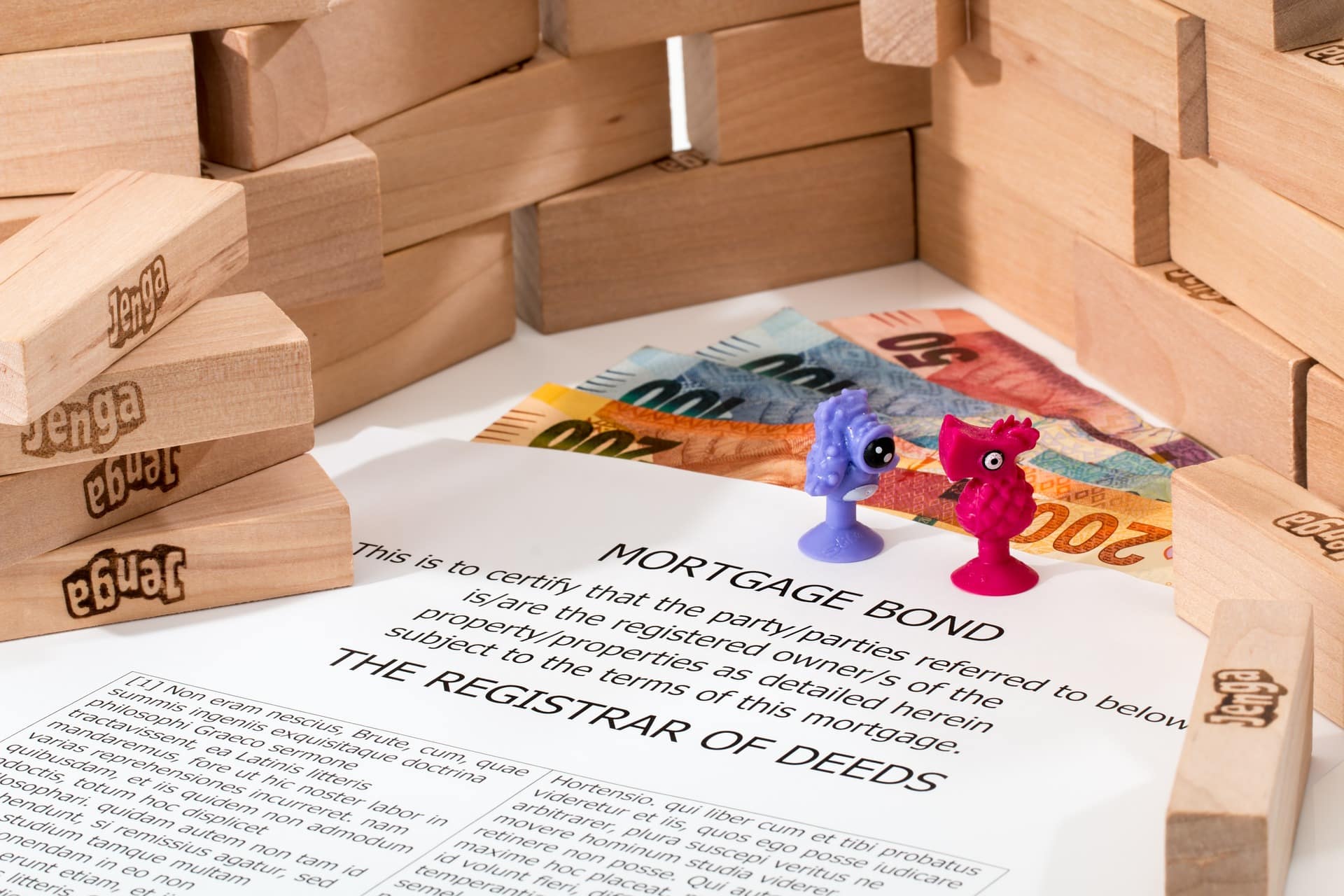

If the relative requests a momentary credit, you should clear every one of the subtleties in the beginning. It might feel abnormal, yet you should examine every one of the terms and sign them. This will stay away from any contention in the future over the advance terms.

Various things should be placed in the credit arrangement. The sum, financing cost, monthly instalments, and credit term are some of them. It is suggested you give some instalment adaptability.

There may come to a circumstance when the borrower quits making full instalment on schedule. You ought to consistently have the activity plan examined in the term. You can build the financing cost, make a legitimate move, or utilise the security for recuperation.

When it comes to personal loans, many other alternatives are there in the UK marketplace. What if you want to help finance your business friend or partner? It means you have to approach business funding to help someone in tricky times.

What will be the ideal source to borrow funds in such circumstances? Perhaps, you need to work hard more in finding out a lender who can offer quick business loans with no credit check in the UK. Yes, these are the specialised loans where you can have instant approval even if you have no or bad credit score.

Nevertheless, it would be best to be smart enough to find genuine deals, as no credit check is mentioned. Try to search for a lender who is doing either a soft credit check or no credit check but on genuine conditions.

- Monetary reward

A monetary reward is an ideal answer for monetary difficulties that requires a limited quantity of cash. You can utilise it to help friends and family that are truly close. Notwithstanding, the sum relies upon your moderateness.

You can gift a sum that will leave you with your own monetary difficulties. Survey the spending plan and track down the most extreme sum you can provide for your relative. While introducing them to the monetary reward, make it clear it’s anything but an advance. You can isolate the entire sum in little portions to fix the issue that might last a couple of months. Search for the expenses if the sum gifted is very significant.

- Help with a Plan

Monetary assistance likewise incorporates directing individuals to deal with their pay and costs. You can utilise your spending procedures to help a relative. It will assist them with chopping down the costs and diminish monetary liabilities.

Show them your spending plan and ensure they comprehend its significance. Then, at that point, make an exhaustive financial plan and reimbursement plan with them. You should track down each conceivable method to cut superfluous costs.

There will be a few inquiries difficult to have in a discussion. The interaction might take the hour of persuading the other party about their pointless spending. However, you ought to request that they make a superior financial plan while regarding their security.

- Discover Help

If you are not in the condition to help somebody monetarily, there are unquestionably alternate approaches to help. You can assist with thinking that they are the help they need to overcome these monetary difficulties. Like this, you will, in any case, pay a critical job in settling their monetary troubles.

Take them to a lifelong guide or a few offices for the jobless. You can likewise suggest an obligation advocate if the reason for the crash issue is a bungle. Assist them with applying for ensured advances for jobless for some monetary assistance.

One of the best examples of it is applying for unemployed loans. Again, you should try them by approaching the private lenders, as conventional lending seems too hard to approach.

- Underwriter Loan

An underwriter loan is a kind of monetary guide from moneylenders that require a risk outsider, called an underwriter. Your relative with an awful credit score will get an unstable underwriter advance at a lower loan cost. Along these lines, you can help them by co-marking a credit.

In any case, there are different dangers implied with an underwriter credit. You will be answerable for taking care of the obligation if the borrower has defaulted on it. Your record of loan repayment will make an extreme effort to any default from your side.

It will be better if you try to consent to co-sign an advance as an underwriter, in particular on the off chance that you trust the other individual. You should have a thorough report of their accounts and the credit terms. Furthermore, in particular, you can request that the loan specialist illuminate you about any missed instalment.

- Take care of Bills

You can likewise present to prepay a few bills during the monetary unsteadiness of the relative. Ask them for the bills and instalments they can’t make in the current circumstance. It will lessen some weight on them while they centre around the reason for the difficulty.

You can pay their home loan, protection charges, or service bills. Help, for example, making exceptional instalments on the vehicle loan will keep away from some significant issues for them. Ensure they unmistakably comprehend whether the assistance is a gift or some sort of advance.

You might need to burrow somewhat more profound to know the neglected bills. It is a more secure choice if you don’t confide in their definitive intention to utilise cash.

If you do not pay the bills on time, they will haunt you badly. They accumulate too much debt for you, which later become tough to consolidate. However, you have the lending options for this situation, too, like debt consolidation. Still, you need to pay your bills on time to avoid the grim consequences.

- Give Them a Job

Giving business will assist with settling the money crunch if the explanation is joblessness. You can enlist them for some assignment at a pre-decided cost. It will keep away from the awkward circumstance of loaning and getting.

You can’t regard them as your relative in the work area. However, they may anticipate a little exceptional treatment from your side. In any case, the issue might emerge while they function as your worker.

Ensure they concur they have what it takes and the capacity for the work. Your standing will be in danger if you commit some genuine error.

- Non-Cash Help

Non-cash help, such as coupons or gift vouchers, is an extraordinary method to help somebody follow their spending. These things are non-refundable. Consequently, it is absolutely impossible that they can spend it on something you will not concur with.

Once more, it will stay away from some awkward discussion about monetary assistance. It is amazingly hard to get some information about the motivation behind their spending. The sum can differ dependent on the sum required and the worth of gift vouchers presented by the store.

- Be More Patient

Persistence is the key to monetary achievement.

Showing restraint can be very intense, particularly when you’re battling with your funds. However, having confidence is awesome. You will consistently be in good shape in case you are making the appropriate strides above.

So don’t be debilitating. Regardless of whether you are just saving a couple of pounds a month, everything adds up. Inside only a couple of years, you will think back gladly at your achievements and be happy that you had the tolerance to arrive.

In the Nutshell

Eventually, the ethical constraint to help your relative during monetary pain does not mean you make monetary issues for yourself. Ensure the assistance you are offering is moderate and safe. Try not to stop for a second in saying no if the sum appears to be irrational or too far in the red.

In the end, you should be positive when trying hard to help someone who is so close to you.